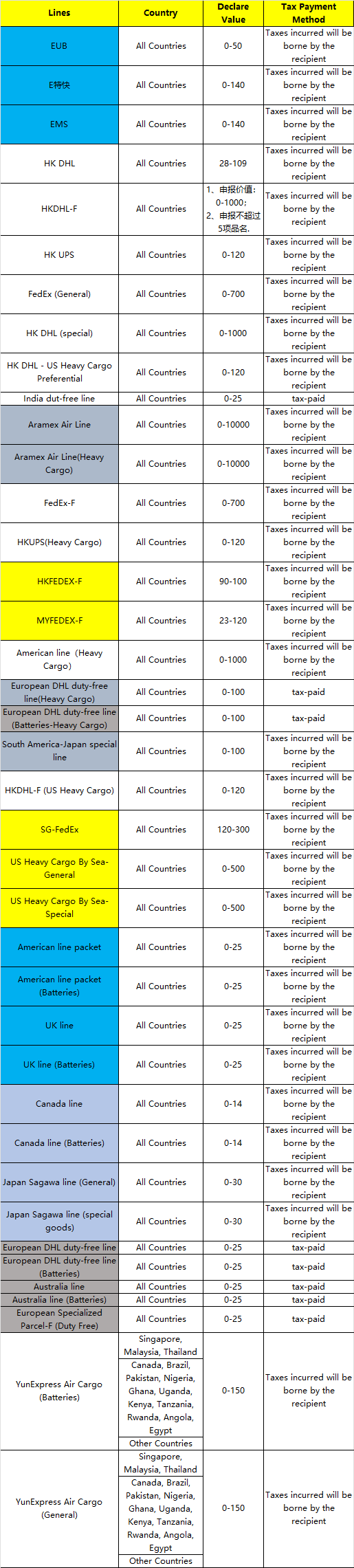

Please note that when submitting parcels via the lines below, you will pay taxes based on the declared value. As the declared value is in USD, if you pay taxes in RMB, the system will convert the currency according to the real-time exchange rate.

Lines involved:

South America-Japan special line

Japan Sagawa line (General)

Japan Sagawa line (special goods)

YunExpress Air Cargo (Batteries)

YunExpress Air Cargo (General)

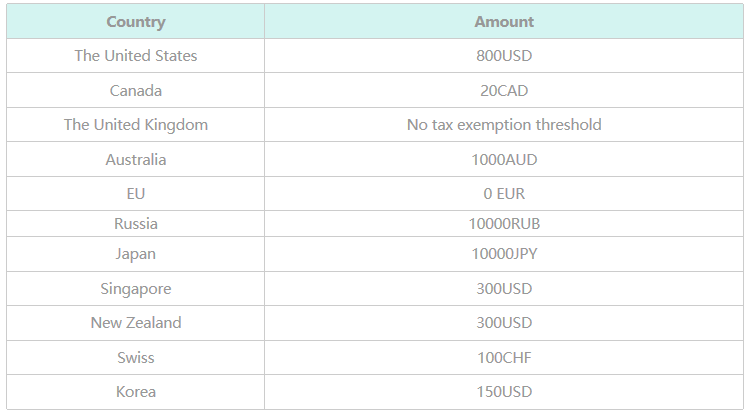

In general, if the declared value of the package is lower than the tariff threshold, the package normally will not be taxed (but fraud declaration is another matter). If your package is taxed, you need to pay taxes and help clear the customs, but the probability of this situation is very small, only 0.3% of the packages have been taxed so far.

States tariff threshold reference table:

Notes:

- The customs tax threshold of Switzerland is 100 Swiss francs and the VAT threshold is 65 Swiss francs.

- Canadian, and European customs are strict in package inspection. Business express such as DHL, and UPS, have a large chance to be taxed.

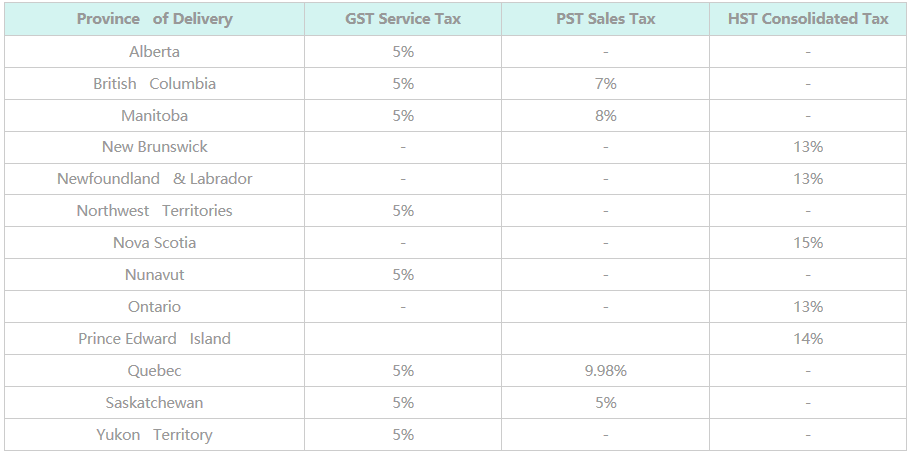

List of the various provinces of Canada's tax

How to avoid paying taxes?

You can refer to the following suggestions:

- The weight of the package is the important basis for the customs to judge the package as a civil parcel or commercial parcel. A package weighing over 10 kg will be considered as a commercial package, so when you submit a delivery order, be sure to confirm the weight of your parcel. If you choose DHL, you also need to consider the volume of items (The charge of DHL is confirmed by both the volume and weight of the commodity).

- The ceiling of the package weight is 30 kg. If your package is more than 30 kg, you can submit delivery orders respectively but suggested that each order cannot be more than 10 kg as well.

- A large number of the same item can be regarded as a commercial package, too. So please avoid using the same parcel to send a lot of a single considerable product.

- As you know, we are sorry to tell you that we cannot give you a 100% guarantee that your parcel will be taxed or not.

Notes:

The number of the item and the weight of the package is the important basis for customs to judge the package as a civil or commercial parcel. A package that is more than 10 kg will be more likely to be seen as a commercial parcel, so when you submit a delivery order, be sure to confirm the weight of your parcel. And a large number of the same item can be regarded as a commercial package, too. So please try separating the single items into different parcels.

Besides, limited by customs policy, especially food items, please be careful to send them overseas.

The above information is collected from the Internet data, only for your reference, and cannot be the standard guidance.

- Risk Related

For shopping agents and parcel forwarding products, the system will notify the potential risks when the order is submitted and verified. After the product is shipped to our warehouse, we will suggest a shipping method with low risk based on the nature of the product and our experience.

Friendly Reminder: Some products are inevitably subject to certain customs risks such as rejection, taxation, and confiscation. Please understand you will be responsible for such risks.

- Customs Declaration

For shopping agents and parcel forwarding products, we will declare the value in a reasonable way based on the customs tax threshold of the destination country and our logistics experience. You can also leave a note and declare the value by yourself when submitting the parcel.

Friendly Reminder: The chance of a parcel being taxed is influenced by the frequency of customs exams and customs policy. Please refer to the Tax Threshold of Different Countries. Please understand that you will be responsible for customs-related risks (return, confiscation, taxation).

Also, the chance of your parcel being inspected by customs will increase if your product is too heavy or valuable. We suggest that you do not put too many same products in one parcel and keep your parcel at a reasonable weight.

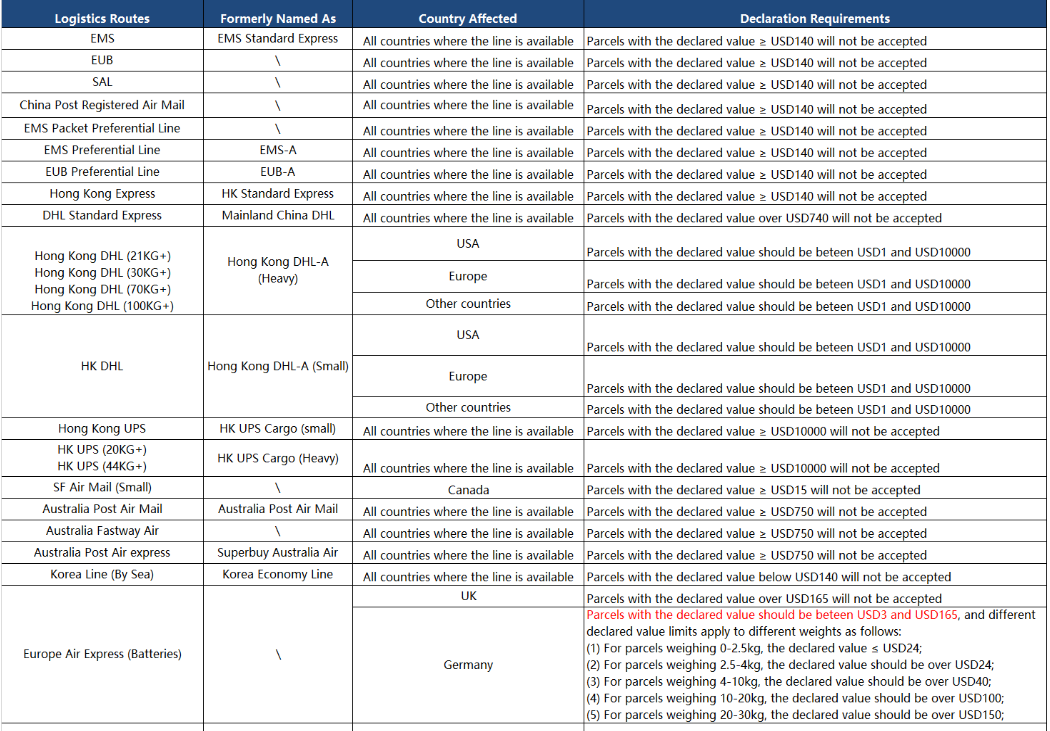

To comply with different countries' tax rules and ensure smooth customs clearance, we suggest that you declare values accurately on parcels sent via logistics lines available on Kameymall, that is, the declared quantity, value, and item name should all be consistent with contents in the parcel.

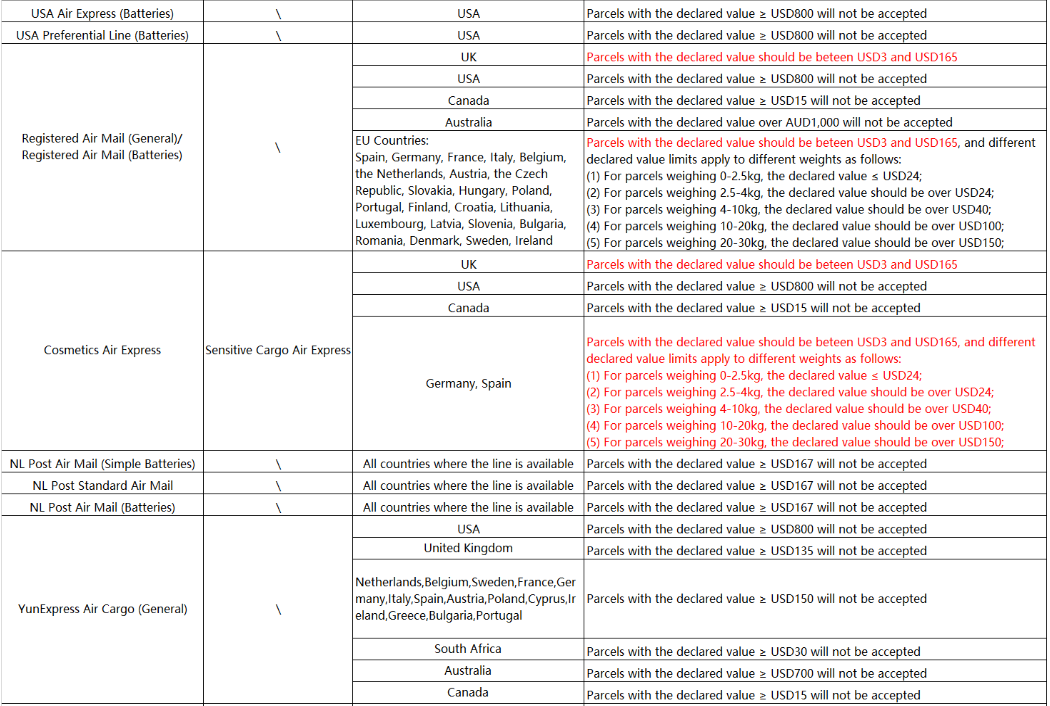

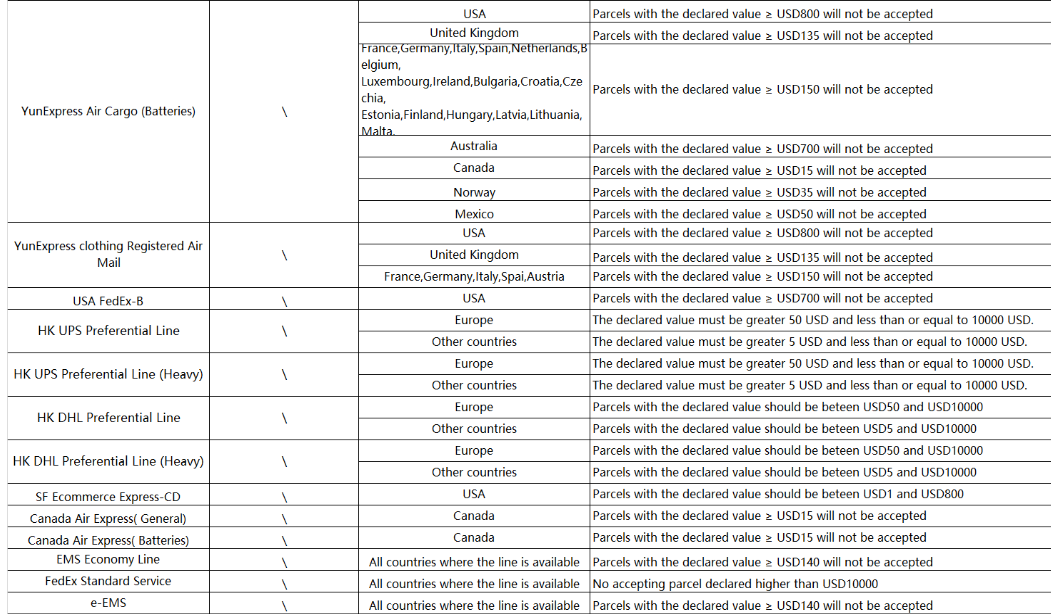

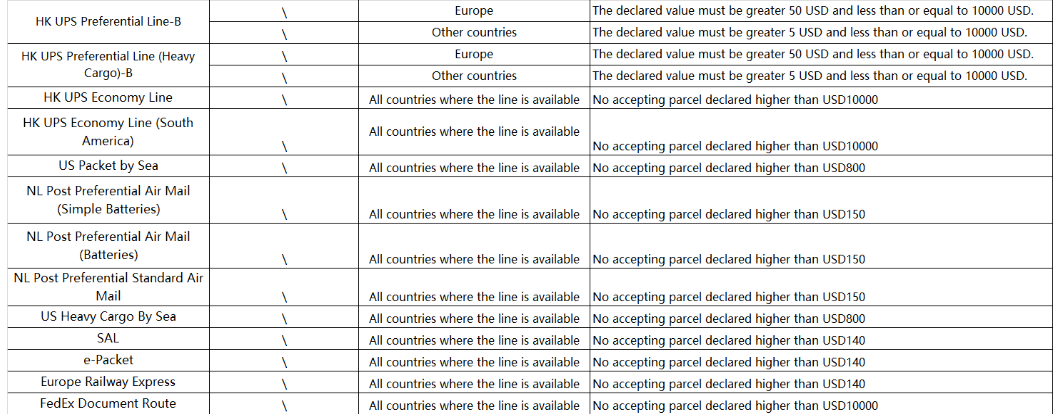

Additionally, as per the requirements of customs at destinations, the logistics provider has placed certain limits on declared values for some lines, exceeding which will result in the following:

(1) Parcel will be returned by the logistics provider;

(2) Parcel may need to be formally declared for export, and you need to provide relevant materials and bear corresponding costs;

(3) Parcel will be taxed and confiscated by local customs;

If the declared values of your parcel exceed such limits, please split it into multiple parcels before shipping, or choose other lines instead.

Specific declaration requirements are as follows:

Note: If the declared values of your parcel exceed such limits, please split it into multiple parcels before shipping, or choose other lines instead.

The parcel sent abroad needs to go through foreign customs, the customs inspection package basically is the form of a spot check. If the customs considers that your package is special (e.g. bulky, heavy, or sensitive), the general customs will proactively contact the recipient for invoice or customs clearance. The cost of the package returned or destroyed will be borne by the addressee on its own due to the lack of contact with the addressee or the addressee not cooperating with the customs clearance.